shall be included in the gross earnings of the one who done these kinds of companies in the first taxable 12 months through which the legal rights of the person possessing the advantageous interest in this sort of home are transferable or are usually not issue to a considerable threat of forfeiture, whichever is applicable.

So how can we earn money? Our associates compensate us. This could affect which products and solutions we overview and compose about (and where those solutions show up on the location), nonetheless it by no means impacts our tips or information, which are grounded in thousands of hrs of investigation.

Navigating equity compensation can be difficult, Particularly With regards to knowing tax implications. A single important tax-preserving Device for startup founders and workforce coping with equity compensation is the 83(b) election.

This is necessary of each lender underneath the Truth of the matter in Lending Act. Should you agree to the costs and charges, the lender will immediate you to an e-signature webpage, plus your financial loan are going to be processed.

As a result, early immediate deposit availability could differ from pay interval to pay for period. The identify and Social Safety selection on file using your employer or Advantages provider ought to match your GO2bank account to prevent fraud limits about the account. when you immediate deposit your shell out or Advantages for your GO2bank account.

Creating the election generally is a intelligent move if you suspect the business valuation will enhance significantly Later on, as it enables you to lock in a decrease tax amount and perhaps spend less in the long run. But customers beware - in case you make the election and afterwards forfeit your RSAs in advance of they vest, or the company fails, you will not be capable of recoup the amount paid upfront.

It’s essential to note that in the event you hold out to file until finally the vesting date, you'll likely have missed the deadline, as your vesting date is normally afterwards than your grant day.

This statement have to involve particular facts as outlined from the IRS and should be filed inside 30 times of obtaining the restricted stock or fairness curiosity.

The professionals whom we match our customers with have their own individual separate investment decision suitability resolve tasks when rendering individualized investment suggestions on the client, and, unique from our periodically monitoring the verifiable credentials on the professionals on our System, Harness Wealth Advisers helps make no illustration and bears no duty for the standard of the customized investment decision guidance that a supervisor renders on behalf of a customer.

Commonly, deferring taxes is an efficient issue — but for those who maintain an appreciating inventory, waiting around to physical exercise non-qualified inventory alternatives probably implies paying out far more in tax than experienced you exercised the shares early and held them.

If an eighty three(b) election was filed Together with the IRS and also the equity price falls or the business files for individual bankruptcy, then the taxpayer overpaid in taxes for shares using a lesser or worthless volume. here Regretably, the IRS isn't going to make it possible for an overpayment declare of taxes beneath the 83(b) election.

Tax rules improve periodically, and they are scheduled to alter yet again in 2026. Accelerating the taxation of stock compensation may suggest locking in more favorable tax guidelines. On the really least, this means taxpayers are a lot less impacted by economic concerns beyond their Regulate.

Not all types of fairness are qualified for an 83(b) election. It’s vital to refer to a tax advisor or other tax Experienced When thinking about an eighty three(b) election in an effort to entirely evaluate your unique problem and likely tax implications.

Having said that, in lots of circumstances, the individual gets equity vesting above numerous a long time. Workers might get paid organization shares as they remain employed after some time.

Neve Campbell Then & Now!

Neve Campbell Then & Now! Shaun Weiss Then & Now!

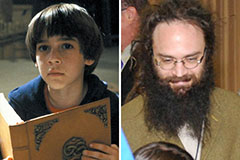

Shaun Weiss Then & Now! Barret Oliver Then & Now!

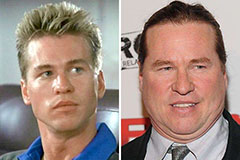

Barret Oliver Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Daryl Hannah Then & Now!

Daryl Hannah Then & Now!